When choosing MA plans, he or she is usually attracted to those referred to as zero-premium plans. Still, who wouldn’t desire an assurance of coverage without paying a dime extra? But the reality is that many of these plans offered with zero premiums are costly, especially for Medicare Arizona and Medicare Alabama. Even though they seem to be integrated with low costs, they can involve hidden charges that may influence your choices and budgets concerning your health.

In this article, we will examine the true cost of the so-called, zero-premium Medicare Advantage plans in Arizona and Alabama as well as tips on how to select the correct plan.

What Are Medicare Advantage Plans?

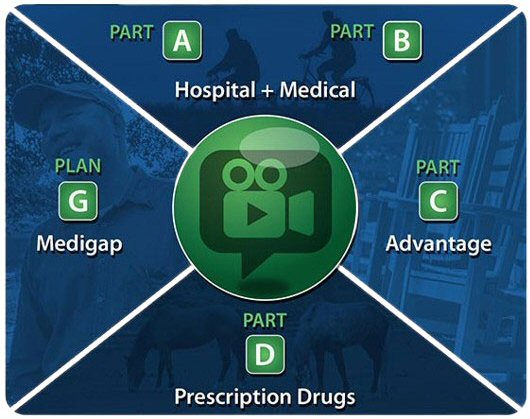

To begin with, Medicare Advantage plans refer to; Medicare Advantage plans available to all those people who enrolled in Medicare Parts A and B according to the following defined sections; Also known as Part C of Medicare, these plans are private insurance accepted by Medicare. They are offered instead of other two Parts – A and B and can offer additional benefits such as prescription drugs as well as dental, vision, and hearing services.

Zero-Premium Medicare Advantage Plans Explained

Typically, zero-premium plans are what they are marketed for – plans that do not include a monthly premium to be paid by the subscriber. But this does not mean that these plans are ‘free of charge’. Instead of contributing a fixed amount in the form of a premium, you contribute more of your money in the form of co-payments, coinsurance, or deductibles.

Why Are Zero-Premium Plans Popular?

But who wouldn’t want a zero-premium Medicare Advantage plan? I have a feeling that people thought that they would be covered more this time for less amount of money. Given that people on fixed income or those who want to spend as little as possible on health insurance will look at zero-premium health plan as the most attractive option.

However, as usual, as is often the case for such a claim to fame, the detail is somewhat different. Both Medicare Arizona and Medicare Alabama patients may realize that the costs of these plans are higher than one might expect.

The True Costs of Zero-Premium Plans

Hidden Out-of-Pocket Costs

The no premium means that there is a monthly allowance for health care services, but it can be very costly concerning what you have to pay before the insurance starts covering your costs. All these costs can be different depending on the chosen plan. For instance, there are some charges that you would have considered to be comprehensively covered such as inpatient services, and physician services which you will be required to cater for from your pocket especially if the plan involves using a set of clinicians.

However, Medicare Arizona has several Medicare Advantage providers that comprise many zero-premium plans. But they have high deductibles or only cover certain doctors and hospitals, meaning you will have to use your money for a lot of your treatment.

Likewise, in Medicare Alabama, although being a member of a zero-premium plan seems free or cheap, a good number of people end up being charged outrageous out-of-network charges or having inflated copayments for basic services.

Drug Coverage Costs

Most of the existing zero-premium Medicare Advantage plans contain prescription drug coverage; nevertheless, the chosen formulary may be relatively small. The problem with the former is that if some prescriptions are not covered by the plan, you either use your money to purchase the medicine or look for a medication that is covered by the plan. Both in Arizona and Alabama, some of the zero-premium plans may exclude the medication you take, meaning you will be facing extra prescription bills.

Limited Network Providers

The other disadvantage of many zero-premium products is the narrow provider networks that are associated with them. These plans have restricted your options when it comes to selecting your physicians, the hospitals you want to attend or even the specialists. Outside the network, you may find yourself paying even more out-of-pocket or discover that the services offered are not covered at all.

The network restrictions can be especially onerous in Medicare Arizona because fewer practitioners are available in rural settings than in urban ones to be contracted to participate in the network of the plan. Likewise in Medicare Alabama, most zero-premium plans do not guarantee certain rural areas or out-of-state services, therefore may result in a compromise of quality services.

Quality of Care

That the cost of obtaining insurance is free in the case of the zero-premium plans is good news, but what about care quality? It was established that some of the Medicare Advantage plans, specially those that may come with no premium to be paid including plans that came with rather low price tags may not necessarily be endowed with many benefits or quality health care services and products as they have had to make some cost-cutting measures which have been financed by the insurance providers.

What Should You Look for in a Medicare Advantage Plan?

If you have Medicare Arizona or Medicare Alabama in particular, you might want to refer to the basic strategies for identifying your health requirements before enrolling yourself in a zero-premium plan. Here’s what you should consider:

1. Review Total Cost, Not Just Premiums

Do not rely solely on the zero-premium name. Spending some time studying the general sum that will be paid: co-payments, deductions, and coinsurance. However, some of the zero-premium plans may be costly especially when all the extra charges are factored in.

2. Check the Provider Network

Ensure that your doctors, and other preferred healthcare providers you would wish to visit are in the plan network. Still, if you have a certain doctor or specialist you would prefer to be receiving your treatment from, he or she must participate in the plan of your choice.

3. Prescription Drug Coverage

If you like these medications, you will have to check the plan’s coverage of your regular medications. While many people may now be able to get health insurance under the PPACA’s requirement for companies to offer zero-premium health plans, they might only be getting limited coverage at best, or they may be paying hefty co-insurance toward their prescription drugs.

4. Compare Plan Ratings

It can be located in Medicare where plan quality ratings, be sure to check it out. These ratings can help you better understand how the plan is performing, the quality of customer service, and the satisfaction of the consumers.

Conclusion

The zero-premium Medicare Advantage plans may sound appealing in Medicare Arizona or Medicare Alabama as they are free of charge, but they come with surprise additional costs. When thinking about why no monthly premium is paid, always think of a broader perspective on what other costs are there such as deductibles, copayment, and out-of-network fees. In the end, the actual cost of a zero-premium plan can be fairly high if your particular needs are not met by the coverage provided by the plan, so always shop carefully to find the one that gives you the most for your money.

Selecting the best Medicare Advantage plan means that one has to compare the kind of health care needs as well as the network of providers and other expenses of the plan. The ideal plan also considers your health needs and wallet; in a nutshell, you cannot exhaust your monetary reserves to receive medical attention you cannot afford.

Explore Our Websites

Explore Our Websites bcrelx.com

bcrelx.com

Leave a Reply